Terms of Service

The following legal agreement (the “Agreement”) governs the relationship between Vagabond Vending LLC or its assigns including Vagabond Rentals & Services LLC (collectively “Vagabond”, “Lessor”, “us”, or “we”) and any party (the “Member”, “Lessee”, “you”, “your”, or “user”) that uses services provided by Vagabond or intellectual property owned by Vagabond, including but not limited to mobile & web software, payment transactions processing, and solutions financing services. The Agreement is effective on the date that the order is placed on vgbnd.co or the written form is executed by Vagabond or Lessor (“Effective Date”) and remain in force for the entire Term as defined below.

This Agreement was Last Updated on February 23, 2018. If you do not understand any of the terms of this Agreement, please contact us at https://vgbnd.co/request-info before using the Application.

You may not access or use any Application unless you agree to abide by all of the terms and conditions in this Agreement.

Quick Links:

End User License Agreement (EULA)

vīv Affiliate Agreement

One Rate Rental & Services Lease

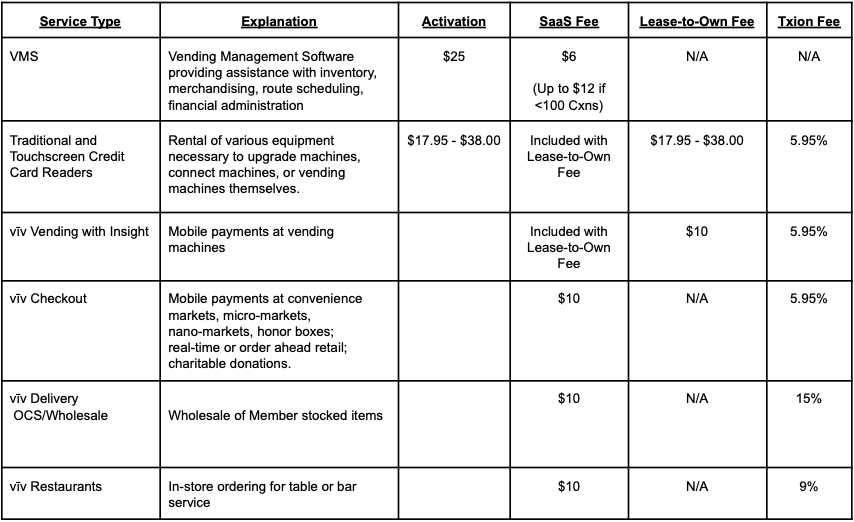

SchedulE of Fees

Agreement Acceptance

Back to TOP

End User License Agreement

Vagabond is the developer and owner of the Vagabond Application (the “Application” or “Vagabond IP”; including but not limited to the Vagabond and vīv software applications, telemetry hardware, payments processing schema, centralized data environment and all associated electronic code) and the Member is in the business of operating a retail operation or using the Application for some other purpose. The Member desires to utilize the Application to assist in its business operation. Vagabond grants and Member accepts a limited, non-exclusive license to access and use the Application solely for Member’s internal business purposes under the following End User License Agreement (the “EULA” as incorporated in the Agreement herein):

a) Vagabond retains ownership of the Application at all times and reserves all rights to it not expressly granted to Member by this EULA.

b) The terms of this license will govern any software upgrades provided by Vagabond that replace and/or supplement the original Application, unless such upgrade is accompanied by a separate license in which case the terms of that license will govern. From time to time, Vagabond may release software updates to the version of the Application that was originally purchased.

c) Member may not and agrees not to, or to enable others to, copy, decompile, reverse engineer, disassemble, attempt to derive the source code of, decrypt, modify, or create derivative works of the Application. Any attempt to do so is a violation of the rights of Vagabond and its affiliates. Member agrees, as a function of this EULA, to enforce to the best of its ability, this restriction upon its users and employees.

d) Any content displayed by the Application is provided for informational purposes only and is not intended to be relied upon solely for revenue generation. To the extent that the Application makes available or links to third-party content, Vagabond makes no warranty that a user will not encounter content that may be deemed offensive, indecent, or objectionable. Vagabond is not responsible for examining or evaluating the content, accuracy, completeness, timeliness, validity, copyright compliance, legality, decency, quality or any other aspect of such third party materials or web sites. Vagabond, its officers, affiliates and subsidiaries do not warrant or endorse and do not assume and will not have any liability or responsibility to any person or entity for any third-party services, third party materials or web sites, or for any other materials, products, or services of third parties.

e) You may choose to or we may invite you to submit comments or ideas about improvements to the Application or any other component of our products or services (“Ideas”). If you submit an Idea to us, we will presume that your submission was voluntary, unsolicited by us, and delivered to us without any restrictions on our use of the Idea. You also agree that Vagabond has no fiduciary or any other obligation to you in connection with any Idea you submit to us, and that we are free to use your Ideas without any attribution or compensation to you.

f) You may not: (i) claim or register ownership of Vagabond IP on your behalf or on behalf of others; (ii) sublicense any rights in Vagabond IP granted by us; (iii) import or export any Vagabond IP to a person or country in violation of any country’s export control Laws; (iv) use Vagabond IP in a manner that violates this EULA or Laws; or (v) attempt to do any of the foregoing.

g) We may make certain Vagabond logos or marks (“Vagabond Marks”) available for use by you and other users to allow you to identify Vagabond as a service provider. Vagabond may limit or revoke your ability to use Vagabond Marks at any time. You may never use any Vagabond Marks or Vagabond IP consisting of trademarks or service marks without our express permission, or in a manner that may lead people to confuse the origin of your products or services with ours.

h) During the term of this EULA, you may publicly identify us as the provider of the Application to you and we may publicly identify you as a Vagabond user. If you do not want us to identify you as a user, please contact us. Neither you nor we will imply any untrue sponsorship, endorsement, or affiliation between you and Vagabond. Upon termination of your Vagabond Account, both you and Vagabond will remove any public references to our relationship from our respective websites.

i) You may use the Application to upload or publish text, images, and other content (collectively, “Content”) to your Vagabond Account and to third-party sites or applications but only if you agree to obtain the appropriate permissions and, if required, licenses to upload or publish any such Content using the Application. You agree to fully reimburse Vagabond for all fees, fines, losses, claims, and any other costs we may incur that arise from publishing illegal Content through the Application, or claims that Content you published infringes the intellectual property, privacy, or other proprietary rights of others.

j) Vagabond and its subsidiaries may collect, maintain, process and use diagnostic, technical, data content and related information, including but not limited to information about users, the system, and peripherals, that is gathered periodically to facilitate the provision of software updates, product support and other services related to the Application, and to verify compliance with the terms of this EULA. Vagabond may use this information, as long as it is in a form that does not personally identify a Member, to improve products, to improve support to partners and Members or to provide or sell aggregate data related information to Vagabond customers, users and partners.

k) Member will defend, indemnify and hold Vagabond, its affiliates, employees, officers, directors and shareholders harmless against any damages and all related costs (including reasonable attorneys' fees) incurred in connection with claims made or brought by a third party based upon, resulting from or related to Member’s acts or omissions.

l) Member acknowledges and agrees that the Application is provided to Client AS IS. VAGABOND HEREBY DISCLAIMS ALL WARRANTIES, WHETHER EXPRESS, IMPLIED OR STATUTORY, INCLUDING WITHOUT LIMITATION, THE IMPLIED WARRANTIES OF QUIET ENJOYMENT, DATA ACCURACY, NONINFRINGEMENT, MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, OR TITLE.

m) Under no circumstances shall Vagabond be liable to Member for any loss of use, interruption of business, lost profits, or for any indirect, special, incidental, or consequential damages of any kind, regardless of the form of action, whether in contract, tort (including negligence), strict product liability or otherwise, even if Vagabond has been advised of the possibility of such damages. Vagabond’s aggregate cumulative liability to Member shall in no event exceed the amounts paid to Vagabond by Member for the Application license.

n) This EULA shall be effective upon Member’s service activation and shall remain in full force and effect for the entire period of use (the “Term”). Vagabond reserves the right to suspend or terminate Member’s access to the Application at any time for any or no reason. Notwithstanding the foregoing, all provisions of this EULA shall survive termination of use.

Quick Links:

End User License Agreement (EULA)

vīv Affiliate Agreement

One Rate Rental & Services Lease

SchedulE of Fees

Agreement Acceptance

Back to TOP

vīv Affiliate Agreement

This section (the “Affiliate T&C” as incorporated in the Agreement herein) outlines the terms and conditions that govern the relationship between Vagabond and the person or entity that is using the Application (“Affiliate”) for purposes of order fulfillment and payment processing, and other business services that may be marketed by Vagabond as vīv Commerce.

Section A: General Terms

1. Overview of this Affiliate T&C

This Affiliate T&C provides a general description of the Application that Vagabond may provide to you, including those that allow you to accept payments from purchasers of your goods or services or donors to your organization (your “Customers”). We provide you with a more detailed description of the Application through published marketing and additional resources we make available to you on our website.

Before using the Application, you must register with Vagabond and create an account (a “Vagabond Account”).

Section A describes the process of registering for and using your Vagabond Account.

Section B describes your use of the Application.

Section C describes the Payment Processing Service, which is one type of Application provided by Vagabond.

Section D describes proper handling, management, and use of data generated during your use of the Application, including your Customers’ data.

Finally, Section E describes your liability to Vagabond for all losses connected with your Vagabond Account, your agreement to resolve all disputes with Vagabond by arbitration and not in a lawsuit, and other legal terms that apply to you.

2. Your Vagabond Account

a. Registration and Permitted Activities: Only businesses (including sole proprietors), bona fide charitable organizations, and other entities or persons located in the United States are eligible to apply for a Vagabond Account to use the Application described in this Affiliate T&C. Vagabond and its affiliates may provide Application to you or your affiliates in other countries or regions under separate Affiliate T&Cs.

To register for a Vagabond Account, you or the person or people submitting the application (your “Representative”) must provide us with your business or trade name, address, email, phone number, tax identification number, URL, the nature of your business or activities, and certain other information about you that we require. We may also collect personal information (including name, birthdate, and government-issued identification number) about your beneficial owners, principals, and your Vagabond Account administrator. Until you have submitted, and we have reviewed and approved, all required information, your Vagabond Account will be available to you on a preliminary basis only, and we may terminate it at any time and for any reason.

If you use Payment Processing Service, your name (or the name used to identify you) and URL may appear on your Customers’ bank or other statements. To minimize confusion and avoid potential disputes, these descriptors must be recognizable to your Customers and must accurately describe your business or activities. You may only use Payment Processing Service to facilitate Transactions (as defined below) with your Customers. You may not use Payment Processing Service to send money to others, to conduct any personal transactions, or for any other purposes prohibited by this Affiliate T&C.

b. Business Representative: You and your Representative individually affirm to Vagabond that your Representative is authorized to provide the information described in this Section A.2 on your behalf and to bind you to this Affiliate T&C. We may require you or your Representative to provide additional information or documentation demonstrating your Representative’s authority. Without the express written consent of Vagabond, neither you nor your Representative may register or attempt to register for a Vagabond Account on behalf of a user Vagabond previously terminated from use of the Application.

If you are a sole proprietor, you and your Representative also affirm that your Representative is personally responsible and liable for your use of the Application and your obligations to Customers, including payment of any amounts owed under this Affiliate T&C.

The following special requirements apply in relation to persons that are not at least 18 years old. If you are an individual or sole proprietor, and you are not at least 18 years old, but you are 13 years old or older, your Representative must be your parent or legal guardian. If you are a legal entity that is owned, directly or indirectly, by an individual who is not at least 18 years old, but the individual is 13 years old or older, your Representative must either obtain the consent of your board or of an authorized officer. Any such approving board, authorized officer, parent, or legal guardian is responsible to Vagabond and is legally bound to this Affiliate T&C as if it had agreed to the terms of this Affiliate T&C itself. You may not use the Application if you are under 13 years of age.

c. Validation and Underwriting: At any time during the term of this Affiliate T&C and your use of the Application, we may require additional information from you to verify beneficial ownership or control of the business, validate information you provided, verify you or your Representative’s identity, and assess the risk associated with your business. This additional information may include business invoices, copies of government-issued identification, business licenses, or other information related to your business, its beneficial owners or principals. If you use Payment Processing Service, we may also request that you provide copies of financial statements or records pertaining to your compliance with this Affiliate T&C, or require you to provide a personal or company guarantee. Your failure to provide this information or material may result in suspension or termination of your Vagabond Account.

You authorize us to retrieve information about you from our service providers and other third parties, including credit reporting agencies and information bureaus and you authorize and direct such third parties to compile and provide such information to us. You acknowledge that this may include your name, addresses, credit history, and other data about you or your Representative. You acknowledge that we may use your information to verify any other information you provide to us, and that any information we collect may affect our assessment of your overall risk to our business. You acknowledge that in some cases, such information may lead to suspension or termination of your Vagabond Account. Vagabond may periodically update this information as part of our underwriting criteria and risk analysis procedures.

d. Changes to Your Business, Keeping your Vagabond Account Current: You agree to keep the information in your Vagabond Account current. You must promptly update your Vagabond Account with any changes affecting you, the nature of your business activities, your Representatives, beneficial owners, principals, or any other pertinent information. We may suspend your Vagabond Account or terminate this Affiliate T&C if you fail to keep this information current. You also agree to promptly notify us in writing no more than three days after any of the following occur: you are the subject of any voluntary or involuntary bankruptcy or insolvency application, petition or proceeding, receivership, or similar action (any of the foregoing, a “Bankruptcy Proceeding”); there is an adverse change in your financial condition; there is a planned or anticipated liquidation or substantial change in the basic nature of your business; you transfer or sell 25% or more of your total assets, or there is any change in the control or ownership of your business or parent entity; or you receive a judgment, writ or warrant of attachment or execution, lien or levy against 25% or more of your total assets.

3. Your Relationship with Your Customers

You may only use the Application for legitimate Transactions with your Customers. You know your Customers better than we do, and you are responsible for your relationship with them. Vagabond is not responsible for the products or services you publicize or sell, or that your Customers purchase using the Application; or if you accept donations, for your communication to your Customers of the intended use of such donations. You affirm that you are solely responsible for the nature and quality of the products or services you provide, and for delivery, support, refunds, returns, and for any other ancillary services you provide to your Customers.

Vagabond provides Application to you but we have no way of knowing if any particular purchase, sale, donation, order, or other transaction (each a “Transaction”) is accurate or complete, or typical for your business. You are responsible for knowing whether a Transaction initiated by your Customer is erroneous (such as a Customer purchasing one item when they meant to order another) or suspicious (such as unusual or large purchases, or a request for delivery to a foreign country where this typically does not occur). If you are unsure if a Transaction is erroneous or suspicious, you agree to research the Transaction and, if necessary, contact your Customer before fulfilling or completing the Transaction. You are solely responsible for any losses you incur due to erroneous or fraudulent Transactions in connection with your use of the Application.

4. Fees and Other Charges

Vagabond will provide the Application to you at the rates and for the fees (“Fees”) described and incorporated into this Affiliate T&C. The Fees include charges for Transactions (such as processing a payment) and for other services connected with your Vagabond Account (such as for SaaS, software services fees, or handling a disputed charge). We may revise the Fees at any time. However, we will provide you with at least 30 days’ advance notice before revisions become applicable to you (or a longer period of notice if this is required by applicable Law).

In addition to the Fees, you are also responsible for any penalties or other exceptional charges imposed in relation to your Vagabond Account on you or Vagabond by Vagabond or any Payment Method Provider or Payment Method Acquirer (each as defined in Section C) resulting from your use of Payment Processing Service in a manner not permitted by this Affiliate T&C or a Payment Method Provider’s rules and regulations.

You are also obligated to pay all taxes, fees and other charges imposed by any governmental authority (“Taxes”), including any value added tax, goods and services tax, provincial sales tax and/or harmonized sales tax on the Application provided under this Affiliate T&C. If you are tax-exempt, you will provide us with an appropriate certificate or other evidence of tax exemption that is satisfactory to us.

5. Application and Vagabond Account Support

We will provide you with support to resolve general issues relating to your Vagabond Account and your use of the Application. This support includes resources and documentation that we make available to you through the current versions of Vagabond’s support pages, API documentation, and other pages on our website or otherwise (collectively, “Documentation”). The most efficient way to get answers to your questions is to review our Documentation. If you still have questions after reviewing the Documentation, please contact us.

You are solely responsible for providing support to Customers regarding Transaction receipts, product or service delivery, support, returns, refunds, and any other issues related to your products and services and business activities. We are not responsible for providing support for the Application to your Customers unless we agree to do so in a separate Affiliate T&C with you or one of your Customers.

6. Taxes and Other Expenses

Our fees are exclusive of any applicable Taxes, except as expressly stated to the contrary. You have sole responsibility and liability for: (i) determining what, if any, Taxes apply to the sale of your products and services, acceptance of donations, or payments you receive in connection with your use of the Application; and (ii) assessing, collecting, reporting, and remitting Taxes for your business to the appropriate tax and revenue authorities. If we are required to withhold any Taxes, or we are unable to validate any tax-related identification information you provide to us, we may deduct such Taxes from amounts otherwise owed and pay them to the appropriate taxing authority. If you are exempt from payment of such Taxes, you must provide us with an original certificate that satisfies applicable legal requirements attesting to your tax-exempt status. Upon our reasonable request, you must provide us with information regarding your tax affairs.

We may send documents to you and tax authorities for Transactions processed using the Application. Specifically, pursuant to applicable Law (including the Internal Revenue Code), we may be required to file periodic informational return with taxing authorities in relation to your use of the Application. If you use Payment Processing Service, you acknowledge that we will report the total amount of payments you receive each calendar year as required by the Internal Revenue Service. We also may, but are not obliged to, electronically send you tax-related information (including, when you provide us your tax identification number, a Form 1099-K).

7. Application Requirements, Limitations and Restrictions

a. Compliance with Applicable Laws: You must use the Application in a lawful manner, and must obey all laws, rules, and regulations (“Laws”) applicable to your use of the Application and to Transactions. As applicable, this may include compliance with domestic and international Laws related to the use or provision of financial services, notification and consumer protection, unfair competition, privacy, and false advertising, and any other Laws relevant to Transactions.

b. Prohibited Businesses and Activities: You may not use the Application to enable any person (including you) to benefit from any activities Vagabond has identified as a prohibited business or activity including investment & credit services, money and legal services, virtual currency or stored value, intellectual property or proprietary rights infringement, counterfeit or unauthorized goods, gambling, regulated or illegal products or services, adult content and services, get rich quick schemes, mugshot publication or pay-to-remove sites, no-value-added services, drug paraphernalia, high risk businesses, multi-level marketing, pseudo pharmaceuticals, social media activity, substances designed to mimic illegal drugs, video game or virtual world credits (collectively, “Prohibited Businesses”). Prohibited Businesses include use of the Application in or for the benefit of a country, organization, entity, or person embargoed or blocked by any government, including those on sanctions lists identified by the United States Office of Foreign Asset Control (OFAC).

Please review the list of Prohibited Businesses thoroughly before registering for and opening a Vagabond Account. If you are uncertain whether a category of business or activity is prohibited or have questions about how these restrictions apply to you, please contact us. We may add to or update the Prohibited Business List at any time in response to your use of the Application.

c. Other Restricted Activities: You may not use the Application to facilitate illegal Transactions or to permit others to use the Application for personal, family or household purposes. In addition, you may not allow, and may not allow others to: (i) access or attempt to access non-public Vagabond systems, programs, data, or services; (ii) copy, reproduce, republish, upload, post, transmit, resell, or distribute in any way, any data, content, or any part of the Application, Documentation, or our website except as expressly permitted by applicable Laws; (iii) act as service bureau or pass-through agent for the Application with no added value to Customers; (iv) transfer any rights granted to you under this Affiliate T&C; (v) work around any of the technical limitations of the Application or enable functionality that is disabled or prohibited; (vi) reverse engineer or attempt to reverse engineer the Application except as expressly permitted by Laws; (vii) perform or attempt to perform any actions that would interfere with the normal operation of the Application or affect use of the Application by our other users; or (ix) impose an unreasonable or disproportionately large load on the Application.

8. Suspicion of Unauthorized or Illegal Use

We may refuse, condition, or suspend any Transactions that we believe: (i) may violate this Affiliate T&C or other agreement you may have with Vagabond; (ii) are unauthorized, fraudulent or illegal; or (iii) expose you, Vagabond, or others to risks unacceptable to Vagabond. If we suspect or know that you are using or have used the Application for unauthorized, fraudulent, or illegal purposes, we may share any information related to such activity with the appropriate financial institution, regulatory authority, or law enforcement agency consistent with our legal obligations. This information may include information about you, your Vagabond Account, your Customers, and Transactions made through your use of the Application.

9. Disclosures and Notices; Electronic Signature Consent

a. Consent to Electronic Disclosures and Notices: By registering for a Vagabond Account, you agree that such registration constitutes your electronic signature, and you consent to electronic provision of all disclosures and notices from Vagabond (“Notices”), including those required by Law. You also agree that your electronic consent will have the same legal effect as a physical signature.

b. Methods of Delivery: You agree that Vagabond can provide Notices regarding the Application to you through our website or through the Application (as defined below), or by mailing Notices to the email or physical addresses identified in your Vagabond Account. Notices may include notifications about your Vagabond Account, changes to the Application, or other information we are required to provide to you. You also agree that electronic delivery of a Notice has the same legal effect as if we provided you with a physical copy. We will consider a Notice to have been received by you within 24 hours of the time a Notice is either posted to our website or emailed to you.

c. SMS and Text Messages: You authorize us to provide Notices to you via text message to allow us to verify your or your Representative’s control over your Vagabond Account (such as through two-step verification), and to provide you with other critical information about your Vagabond Account. Standard text or data charges may apply to such Notices. Where offered, you may disable text message notifications in the Application by responding to any such message with “STOP”, or by following instructions provided in the message. However, by disabling text messaging, you may be disabling important Security Controls (as defined below) on your Vagabond Account and may increase the risk of loss to your business.

d. Requirements for Delivery: You will need a computer or mobile device, Internet connectivity, and an updated browser to access your Application and review the Notices provided to you. If you are having problems viewing or accessing any Notices, please contact us and we can find another means of delivery.

e. Withdrawing Consent: Due to the nature of the Application, you will not be able to begin using the Application without agreeing to electronic delivery of Notices. However, you may choose to withdraw your consent to receive Notices electronically by terminating your Vagabond Account.

10. Termination

a. Term and Termination: This Affiliate T&C is effective upon the date you first access or use the Application and continues until terminated by you or Vagabond. You may terminate this Affiliate T&C by closing your Vagabond Account at any time and ceasing to use the Application. If you use the Application again or register for another Vagabond Account, you are consenting to this Affiliate T&C. We may terminate this Affiliate T&C or close your Vagabond Account at any time for any reason by providing you Notice. We may suspend your Vagabond Account and your ability to access funds in your Vagabond Account, or terminate this Affiliate T&C, if (i) we determine in our sole discretion that you are ineligible for the Application because of significant fraud or credit risk, or any other risks associated with your Vagabond Account; (ii) you use the Application in a prohibited manner or otherwise do not comply with any of the provisions of this Affiliate T&C; (iii) any Law, Payment Method Provider or Payment Method Acquirer requires us to do so; or (iv) we are otherwise entitled to do so under this Affiliate T&C.

b. Effects of Termination: Termination does not immediately relieve you of obligations incurred by you under this Affiliate T&C. Upon termination, you agree to (i) complete all pending Transactions, (ii) stop accepting new Transactions, and (iii) immediately remove all Vagabond and payment network logos from your website (unless permitted under a separate license with the payment network). Your continued or renewed use of the Application after all pending Transactions have been processed serves to renew your consent to the terms of this Affiliate T&C. If you terminate this Affiliate T&C, we will pay out any remaining funds owed to you in accordance with Section C.

In addition, upon termination you understand and agree that (i) all licenses granted to you by Vagabond under this Affiliate T&C will end; (ii) subject to Section D.5, we reserve the right (but have no obligation) to delete all of your information and account data stored on our servers; (iii) we will not be liable to you for compensation, reimbursement, or damages related to your use of the Application, or any termination or suspension of the Application or deletion of your information or account data; and (iv) you are still liable to us for any Fees or fines, or other financial obligation incurred by you or through your use of the Application prior to termination.

Section B: Vagabond Technology

1. Mobile and Web Access to the Application

Vagabond has developed and provides access to the Application through various mobile and web products. You may use the Application solely as described in the Documentation and this Agreement. You may manage your Vagabond Account and enable additional features through our website and your Vagabond Account.

You may not use the Application for any purpose, function, or feature not described in the Documentation or otherwise communicated to you by us. Due to the nature of the Application, we will update the Application and Documentation from time to time, and may add or remove functionality. We will provide you Notice in the event of material changes, deprecations, or removal of functionality from the Application so that you may continue using the Application with minimal interruption.

2. Ownership of Vagabond IP

Vagabond exclusively owns all rights, title, and interest in the patents, copyrights (including rights in derivative works), moral rights, rights of publicity, trademarks or service marks, logos and designs, trade secrets, and other intellectual property embodied by, or contained in the Application (collectively, “Vagabond IP”) or any copies thereof. Vagabond IP is protected by copyright, trade secret, patent, and other intellectual property Laws, and all rights in Vagabond IP not expressly granted to you in this Affiliate T&C are reserved.

Section C: Payment Processing Service

1. Payment Processing Service Overview

Vagabond works with various Vagabond affiliates, Payment Method Providers and Payment Method Acquirers to provide you with access to the Payment Methods and Payment Processing Service. Where the Payment Processing Service enable you to submit Charges (as defined below), we may limit or refuse to process Charges for any Prohibited Businesses, or for Charges submitted in violation of this Affiliate T&C. Your use of a Payment Method may be subject to separate terms applicable to the Payment Method.

The following terms used in this Affiliate T&C relate to your use of Payment Processing Service:

“Charge” means a credit or debit instruction to capture funds from an account that a Customer maintains with a bank or other financial institution in connection with a Transaction.

“Dispute” means an instruction initiated by a Customer for the return of funds for an existing Charge (including a chargeback or dispute on a payment card network; and disputes on the Automated Clearinghouse (ACH) network).

“Fine” means any fines, levies, or other charges imposed by us, a Payment Method Provider or a Payment Method Acquirer, caused by your violation of Laws or this Affiliate T&C, or as permitted by the applicable Payment Method Rules.

“Payment Method Rules” means the guidelines, bylaws, rules, and regulations imposed by the Payment Method Providers and Payment Method Acquirers that operate Payment Methods supported by Vagabond (including the payment card network operating rules (“Network Rules”) for the Visa, Mastercard, Discover and American Express networks; and the NACHA operating rules that apply to the ACH network).

“Payment Method” means a type of payment method that Vagabond accepts as part of the Payment Processing Service, such as credit card, debit card, and ACH.

“Payment Method Acquirer” means a financial institution that is authorized by a Payment Method Provider to enable the use of a Payment Method by accepting Charges from Customers on behalf of the Payment Method Provider, and routing these Charges to the Payment Method Provider.

“Payment Method Provider” means the provider of a Payment Method, such as Visa, Mastercard, Discover, and American Express.

“Payment Processing Service” are Applications that you may use to accept payments from your Customers for Transactions, perform other financial transactions, manage subscriptions, and perform transaction reporting.

“Refund” means an instruction initiated by you to return funds to a Customer for an existing Charge.

“Return” means an instruction initiated by you, a Customer, a Payment Method Provider or a Payment Method Acquirer to return funds unrelated to an existing Charge.

“Reversal” means an instruction initiated by a Payment Method Provider, a Payment Method Acquirer or us to return funds for an existing Charge. Reversals may result from (i) invalidation of a charge by a Payment Method Provider or a Payment Method Acquirer; (ii) funds settled to you in error or without authorization; and (iii) submission of a Charge in violation of the applicable Payment Method Rules, or where submission of the Charge or your use of Payment Processing Service violates this Affiliate T&C.

2. Registering for Use of Payment Processing Service

When you register for a Vagabond Account, you may be asked for financial information, or information we use to identify you, your Representatives, principals, beneficial owners, and other individuals associated with your Vagabond Account. Throughout the term of this Affiliate T&C, we may share information about your Vagabond Account with Payment Method Providers and Payment Method Acquirers in order to verify your eligibility to use the Payment Processing Service, establish any necessary accounts or credit with Payment Method Providers and Payment Method Acquirers, monitor Charges and other activity, and conduct risk management and compliance reviews. We will review and may conduct further intermittent reviews of your Vagabond Account information to determine that you are eligible to use the Payment Processing Service. Vagabond’s use of the information you provide to us under this Affiliate T&C is described in more detail in Section D.

Vagabond is not a bank and we do not accept deposits, provide loans or extend credit. If you accept payment for products or services (including events such as concerts or other performances) not immediately deliverable to the Customer (a “Preorder”), we may, in our sole discretion, initiate Reversals or hold Reserves for all or a portion of the Charges processed by us for a Preorder. If you would like to receive payment for a Preorder, please contact us before doing so.

3. Processing Transactions; Disputes, Refunds, Reversals

You may only submit Charges through the Payment Processing Service that are authorized by your Customers. To enable us to process Transactions for you, you authorize and direct us, our affiliates, the Payment Method Providers and Payment Method Acquirers to receive and settle any payment processing proceeds owed to you through the Payment Processing Service. You may not grant or assign any interest in payment processing proceeds to any third party until such time as the payment processing proceeds are designated to be deposited into your Payout Account (as defined below). You appoint Vagabond as your agent for the limited purpose of directing, receiving, holding and settling such proceeds.

Except where Vagabond and a Customer have otherwise agreed, you maintain the direct relationship with your Customers and are responsible for: (i) acquiring appropriate consent to submit Charges through the Payment Processing Service on their behalf; (ii) providing confirmation or receipts to Customers for each Charge; (iii) verifying Customers’ identities; and (iv) determining a Customer’s eligibility and authority to complete Transactions. However, even authorized Transactions may be subject to a Dispute. Vagabond is not responsible for or liable to you for authorized and completed Charges that are later the subject of a Dispute, Refund, or Reversal, are submitted without authorization or in error, or violate any Laws.

You are immediately responsible to us for all Disputes, Refunds, Reversals, Returns, or Fines regardless of the reason or timing. We may decline to act upon a Refund instruction, or delay execution of the instruction, if: (i) it would cause your Vagabond Account balance to become negative; (ii) you are the subject of Bankruptcy Proceedings; or (iii) where we otherwise believe that there is a risk that you will not meet your liabilities under this Affiliate T&C (including with respect to the Charge that is the subject of the Refund instruction).

In many but not all cases, you may have the ability to challenge a Dispute by submitting evidence to Vagabond. We may request additional information to provide to Payment Method Providers and Payment Method Acquirers to assist you in contesting the Dispute, but we cannot guarantee that your challenge will be successful. Payment Method Providers and Payment Method Acquirers may deny your challenge for any reason they deem appropriate. Where a challenge is entirely or partially successful, your Vagabond Account will, subject to our exercise of our rights under Section C.9 below, be credited with the funds associated with the Charge that is the subject of the Dispute (or a portion thereof). You may not submit a new Charge which duplicates a Transaction that is subject to a Dispute.

Please keep in mind that, as explained in Section D.3, you are liable for all losses you incur when lost or stolen payment credentials or accounts are used to purchase products or services from you. Vagabond does not and will not insure you against losses caused by fraud under any circumstances. For example, if someone pretends to be a legitimate buyer but is a fraudster, you will be responsible for any resulting costs, including Disputes, even if you do not recover the fraudulently purchased product.

A Reversal for a Charge may be issued if the Charge is made without the account owner’s authorization or in connection with a Prohibited Business, violates the applicable Payment Method Rules, or for other applicable reasons. If a Reversal is issued, we will provide you Notice and a description of the cause of the Reversal.

4. Responsibilities and Disclosures to Your Customers

It is very important to us that your Customers understand the purpose, amount, and conditions of Charges you submit to us. With that in mind, when using the Payment Processing Service you agree to: (i) accurately communicate, and not misrepresent, the nature of the Transaction, and the amount of the Charge in the appropriate currency wherever the good is for sale; (ii) provide a receipt that accurately describes each Transaction to Customers; (iii) provide Customers a meaningful way to contact you in the event that the product or service is not provided as described; (iv) not use Application to sell products or services in a manner that is unfair or deceptive, exposes Customers to unreasonable risks, or does not disclose material terms of a purchase in advance; and (v) inform Customers that Vagabond and its affiliates process Transactions (including payment Transactions) for you. You also agree to maintain and make available to your Customers a fair and neutral return, refund, cancellation, or adjustment policy, and clearly explain the process by which Customers can receive a Refund.

You may use the Payment Processing Service to receive recurring or subscription payments from your Customers. If you use the Payment Processing Service to submit these recurring or subscription Charges, you agree to comply with applicable Laws, including clearly informing Customers in advance of submitting the initial Charge that they will be charged on an ongoing basis and explaining the method for unsubscribing or cancelling their recurring billing or subscription.

If you engage in Transactions with Customers who are individuals (i.e. consumers), you specifically agree to provide consumers disclosures required by Law, and to not engage in unfair, deceptive, or abusive acts or practices (“UDAAP”).

5. Payment Terms

Your use of the Payment Processing Service may be subject to additional terms that apply between you and one or more of Vagabond, a Vagabond affiliate, and a Payment Method Provider. When these additional terms relate to a specific Payment Method they are “Payment Terms”. By using the Payment Processing Service, you agree to the applicable Payment Terms, including those that separately bind you with our affiliates, Payment Method Providers and/or Payment Method Acquirers. Additionally, a Payment Method Provider may enforce the terms of this Affiliate T&C directly against you.

We may add or remove Payment Method Providers and Payment Method Acquirers at any time. The Payment Terms may also be amended from time to time. Your continuing use of the Payment Processing Service constitutes your consent and agreement to such additions, removals and amendments.

6. Specific Payment Methods

a. Payment Cards: When accepting payment card payments, you must comply with all applicable Network Rules, including the Network Rules specified by the Visa Rules and Regulations Rules specified by Visa U.S.A., Inc. and Visa International (“Visa”), the Mastercard Rules specified by MasterCard International Incorporated (“Mastercard”), the American Express Merchant Operating Guide specified by American Express, and the Discover Network Rules (please contact Discover for a copy) specified by Discover Financial Application, LLC (“Discover”). Collectively, Visa, Mastercard, American Express and Discover are referred to in this Affiliate T&C as the “Networks”.

In addition, for Visa, Mastercard and Discover Transactions, Visa, Mastercard and Discover may require that you enter into a direct contractual relationship their Payment Method Acquirer for these types of Transactions.

The Network Rules state that you may only accept payments using payment cards for bona fide legal commercial transactions for goods or services that are free of liens, claims, and encumbrances. You may only use payment network trademarks or service marks consistent with the Network Rules, and the Network Rules also limit your ability to discriminate by card type or charge surcharges for acceptance of payment cards.

The Networks may amend the Network Rules at any time without notice to you, and Vagabond reserves the right to change the Payment Processing Service at any time to comply with the Network Rules. We may share with the Networks (and the Payment Method Acquirer) information you provide to us that we use to identify the nature of your products or services, including the assignment of your business activities to a particular payment network merchant category code (MCC).

Customers typically raise payment card network Disputes (also known as “chargebacks”) when a merchant fails to provide the product or service to the Customer, or where the payment card account holder did not authorize the Charge. High Dispute rates (typically those exceeding 1%) may result in your inability to use the Payment Processing Service. Failure to timely and effectively manage Disputes with your Customers may ultimately result in your inability to accept payment cards for your business.

When you accept payment card Transactions, Network Rules specifically prohibit you from (i) providing cash refunds for a Charge on a credit card, unless required by Laws, (ii) accepting cash, its equivalent, or any other item of value for a Refund, (iii) acting as a payment intermediary or aggregator, or otherwise reselling Payment Processing Service on behalf of others, (iv) submitting what you believe or know to be a fraudulent Charge, or (v) using Payment Processing Service in a manner that is an abuse of the payment card networks or a violation of the Network Rules.

If you misuse the Payment Processing Service for payment card Transactions or engage in activity the Networks identify as damaging to their brand, or if we are required to do so by the Network Rules, we may submit information about you, Representatives, your beneficial owners and principals, and other individuals associated with your Vagabond Account, to the MATCH terminated merchant listing maintained by Mastercard and accessed and updated by Visa and American Express, or to the Consortium Merchant Negative File maintained by Discover. Addition to one of these lists may result in your inability to accept payments from payment cards. You understand and consent to our sharing this information and to the listing itself, and you will fully reimburse us for any losses we incur from third-party claims, and you waive your rights to bring any direct claims against us that result from such reporting. Our reporting of information under this paragraph is separate from any other right that we may exercise under this Affiliate T&C, and we may separately terminate this Affiliate T&C or suspend your Vagabond Account due to the misuse or damaging activity that caused us to make the report.

b. Automated Clearinghouse (ACH): The ACH network is controlled and managed by the National Automated Clearinghouse Association (NACHA) and its member organizations. Where submitting Charges over the ACH network, you are required to comply with the NACHA Operating Rules. NACHA may amend the NACHA Operating Rules at any time, and we may amend this Affiliate T&C or make changes to the Payment Processing Service as necessary to comply with the NACHA Operating Rules.

You understand and accept your role as the Originator (as defined in the NACHA Operating Rules). You agree to obtain your Customer’s consent to debit or credit their bank account and initiate a Charge over the ACH network. Such consent must be in a form and manner that complies with the NACHA Operating Rules and the Documentation for ACH Transactions. As with other Payment Processing Service, you may not, and may not attempt to send or receive funds to or from a person, entity, or state where such Transactions are prohibited by applicable Law. You also agree to maintain the security and integrity of all information you collect as part of an ACH Transaction.

Any Disputes or unauthorized Charges using the ACH network may result in you becoming unable to accept ACH payments.

7. Settlement and Payout Schedule

a. Settlement to Your Payout Account: Vagabond will, with its banking partners, arrange to settle funds to the bank or other financial institution account that you designate in the Application (your “Payout Account”). A positive balance in your Vagabond Account will result in settlement to your Payout Account and a negative balance in your Vagabond Account will result in a deduction, set-off and/or debit of the amounts owed in accordance with Section C.9 below. We may reduce the amount settled to your Payout Account by the amount of Fees, Fines, and amounts owed to us for any reason. You affirm that you are authorized to initiate settlements to and debits from the Payout Account. If a settlement or debit is processed via ACH, you acknowledge that the NACHA Operating Rules will apply to the settlement or debit, and you agree to be bound by these rules.

We may offer you the ability to have funds settled to your Payout Account in a currency different from the one in which you accepted payment from a customer (“Multi-Currency Processing”). To use this service, you must provide us with a valid Payout Account for each currency for which you request settlement, based on our list of available settlement currencies. We may add or remove currencies from our list of available settlement currencies at any time. If you use Multi-Currency Processing, we will identify at the time of the Charge, the conversion rate that will apply to the Charge. If you Refund a Charge, the conversion rate that will apply will be the rate in effect at the time of the Refund, not the Charge. By submitting a Charge or Refund you will be deemed to have accepted the applicable conversion rate. You may choose not to use the Multi-Currency Processing service at any time. You may also change the Payout Account information or other settings associated with your use of Multi-Currency Processing, but any such changes will only affect subsequent Charges.

b. Payout Schedule: The term “Payout Schedule” refers to the time it takes for us to initiate settlement to your Payout Account. Your Payout Schedule will be specified to you by Vagabond by separate correspondence. Vagabond may require a holding period before making initial settlement to the Payout Account. After the initial settlement of funds, we will settle funds to the Payout Account according to the Payout Schedule; however, please be aware that a Payment Method Provider, a Payment Method Acquirer, or the financial institution holding your Payout Account, may delay settlement for any reason. We are not responsible for any action taken by the institution holding your Payout Account to not credit the Payout Account or to otherwise not make funds available to you as you expected.

We reserve the right to change the Payout Schedule or to suspend settlement to you. Examples of situations where we may do so are: (i) where there are pending, anticipated, or excessive Disputes, Refunds, or Reversals; (ii) in the event that we suspect or become aware of suspicious activity; or (iii) where we are required by Law or court order. We have the right to withhold settlement to your Payout Account upon termination of this Affiliate T&C if we reasonably determine that we may incur losses resulting from credit, fraud, or other legal risks associated with your Vagabond Account. If we exercise our right to withhold a Payout for any reason, we will communicate the general reason for withholding the Payout and give you a timeline for releasing the funds.

c. Incorrect Settlement: The information required for settlement will depend on the financial institution holding the Payout Account. Please make sure that any information about the Payout Accounts that you provide to us is accurate and complete. If you provide us with incorrect information (i) you understand that funds may be settled to the wrong account and that we may not be able to recover the funds from such incorrect transactions and (ii) you agree that you are solely responsible for any losses you or third parties incur due to erroneous settlement transactions, you will not make any claims against us related to such erroneous settlement transactions, and you will fully reimburse us for any losses we incur.

8. Clearing Funds and Reserves

All funds resulting from Charges are held in pooled clearing accounts (the “Clearing Accounts”) with our banking partners. We will settle funds to and from the Clearing Accounts in the manner described in this Affiliate T&C; however, you have no rights to the Clearing Accounts or to any funds held in the Clearing Accounts, you are not entitled to draw funds from the Clearing Accounts, and you will not receive interest from funds maintained in the Clearing Accounts.

In certain circumstances, we may require you to place funds in reserve or to impose conditions on the release of funds (each a “Reserve”). We may impose a Reserve on you for any reason if we determine that the risk of loss to Vagabond, Customers, or others associated with your Vagabond Account is higher than normal. For example, we may hold a Reserve if: (i) your or your Customers’ activities increase the risk of loss to us or to your Customers, (ii) you have violated or are likely to violate this Affiliate T&C, or (iii) your Vagabond Account has an elevated or abnormally high number of Disputes. If we impose a Reserve, we will establish the terms of the Reserve and provide you Notice of the amount, timing, and conditions upon which the funds in the Reserve will be released to you. In many cases, the Reserve amount will be the entire amount of Charges processed using the Payment Processing Service. We may change or condition the terms of the Reserve based on our continuous assessment and understanding of the risks associated with your Vagabond Account, if required to do so by Payment Method Providers or Payment Method Acquirers, or for any other reason. We may fund the Reserve with funds processed through your use of Payment Processing Service, by debiting the Payout Account or another bank account associated with your Vagabond Account, or by requesting funds directly from you.

To the extent possible, we prefer to identify the necessity for a Reserve in advance of establishing one. If you are concerned that we will impose a Reserve on you due to the nature of your business activities, please contact us before using the Application.

9. Security Interests, Collection, and Set-Off Rights

a. Security Interests: You grant us a lien and security interest in all funds for Transactions that we process for you, including funds that we deposit into your Payout Accounts, as well as funds held in any other bank accounts to which such Transaction funds are deposited or transferred. This means that if you have not paid funds that you owe to us, your Customers, or to any of our affiliates, we have a right superior to the rights of any of your other creditors to seize or withhold funds owed to you for Transactions that we process through the Application, and to debit or withdraw funds from any bank account associated with your Vagabond Account (including your Payout Accounts). Upon our request, you will execute and deliver any documents and pay any associated fees we consider necessary to create, perfect, and maintain a security interest in such funds (such as the filing of a form UCC-1).

b. Collection and Set-Off Rights: You agree to pay all amounts owed to us and to our affiliates on demand. Your failure to pay amounts owed to us or to our affiliates under this Affiliate T&C is a breach and you will be liable for any costs we incur during collection in addition to the amount you owe. Collection costs may include, attorneys’ fees and expenses, costs of any arbitration or court proceeding, collection agency fees, any applicable interest, and any other related cost. Where possible, we will first attempt to collect or set-off amounts owed to us and to or affiliates from balances in your Vagabond Accounts from your use of the Payment Processing Service or from funds that we hold in Reserve. However, we may collect any amounts you owe us under this Affiliate T&C by deducting or setting-off amounts that you owe from the Vagabond account balance (or debiting the payout account for such Vagabond account) for any Vagabond account that we determine, acting reasonably, is associated with your Vagabond Account. Similarly, we may deduct or set-off amounts from your Vagabond Account balance (or debit your Payout Accounts) in order to collect amounts owed to us in relation to such associated Vagabond accounts.

In certain circumstances, we may require a personal, parent or other guarantee (a “Guarantee”) from a user’s principal, owner, or other guarantor. A Guarantee consists of a legally binding promise by an individual or an entity to pay any amounts the user owes in the event that the user is unable to pay. If we require you to provide us with a Guarantee, we will specifically inform you of the amount of, and the reasons for the Guarantee. If you are unable to provide such a Guarantee when required, you will not be permitted to use the Application.

10. Reconciliation and Error Notification

The Application contains details of Charges, Charge history, and other activity on your Vagabond Account. Except as required by Law, you are solely responsible for reconciling the information in the Application generated by your use of Payment Processing Service with your records of Customer Transactions, and for identifying any Transaction errors. You agree to review your Vagabond Account and immediately notify us of any errors. We will investigate any reported errors, including any errors made by Vagabond or a Payment Method Provider, and, when appropriate, attempt to rectify them by crediting or debiting the Payout Account identified in the Application. However, you should be aware that your ability to recover funds you have lost due to a Transaction error may be very limited or even impossible, particularly if we did not cause the error, or if funds are no longer available in any Payout Account. We will work with you and our Payment Method Providers to correct a Transaction error in accordance with the applicable Payment Method Rules; however, if you fail to communicate a Transaction error to us for our review without undue delay and, in any event, within 60 days after the Transaction, you waive your right to make any claim against us or our Payment Method Providers for any amounts associated with the Transaction error.

11. Dormant Accounts

If you leave any funds dormant in a Vagabond Account and you do not give us instructions where to send them, we may be required by Law to deem the funds to be abandoned by you, and to deliver them to various government agencies. To the extent required by Law, we will attempt to provide you Notice if we hold funds payable to you in an account beyond the applicable dormancy period for abandoned property. If we are unable to contact you, we will treat the funds in your Vagabond Account to be abandoned, and will deliver them to the appropriate government authority.

Section D: Data Usage, Privacy, and Security

1. Data Usage Overview

Protecting, securing, and maintaining the information processed and handled through the Application is one of our top priorities, and it should be yours too. This section describes our respective obligations when handling and storing information connected with the Application. The following terms used in this section relate to data provided to Vagabond by you or your Customers, or received or accessed by you through your use of the Application:

“Payment Account Details” means the Payment Method account details for a Customer, and includes, with respect to credit and debit cards, the cardholder’s account number, card expiration date, and CVV2.

“Payment Data” means Payment Account Details, information communicated to or by Payment Method Provider or Payment Method Acquirer, financial information specifically regulated by Laws and Payment Method Rules, and any other information used with the Payment Processing Service to complete a Transaction.

“Personal Data” means information that identifies a specific living person (not a company, legal entity, or machine) and is transmitted to or accessible through the Application.

“Vagabond Data” means details of the API transactions over Vagabond infrastructure, information used in fraud detection and analysis, aggregated or anonymized information generated from Data, and any other information created by or originating from Vagabond or the Application.

“User Data” means information that describes your business and its operations, your products or services, and orders placed by Customers.

The term “Data” used without a modifier means all Personal Data, User Data, Payment Data, and Vagabond Data.

Vagabond processes, analyzes, and manages Data to: (a) provide Application to you, other Vagabond users, and Customers; (b) mitigate fraud, financial loss, or other harm to users, Customers and Vagabond; and (c) analyze, develop and improve our products, systems, and tools. Vagabond provides Data to third-party service providers, including Payment Method Providers, Payment Method Acquirers, and their respective affiliates, as well as to Vagabond’s affiliates, to allow us to provide Application to you and other users. We do not provide Personal Data to unaffiliated parties for marketing their products unless your Customer allows it in the Application. You understand and consent to Vagabond’s use of Data for the purposes and in a manner consistent with this Section D.

2. Data Protection and Privacy

a. Confidentiality: Vagabond will only use User Data as permitted by this Affiliate T&C, by other agreements between you and us, or as otherwise directed or authorized by you. You will protect all Data you receive through the Application, and you may not disclose or distribute any such Data, and you will only use such Data in conjunction with the Application and as permitted by this Affiliate T&C or by other agreements between you and us. Neither party may use any Personal Data to market to Customers unless it has received the express consent from a specific Customer to do so. You may not disclose Payment Data to others except in connection with processing Transactions requested by Customers and consistent with applicable Laws and Payment Method Rules.

b. Privacy: Protection of Personal Data is very important to us. Our Privacy Policy, accessible at https://vgbnd.co/privacy, explains how and for what purposes we collect, use, retain, disclose, and safeguard the Personal Data you provide to us. You agree to review the terms of our Privacy Policy, which we update from time to time.

You affirm that you are now and will continue to be compliant with all applicable Laws governing the privacy, protection, and your use of Data that you provide to us or access through your use of the Application. You also affirm that you have obtained all necessary rights and consents under applicable Laws to disclose to Vagabond – or allow Vagabond to collect, use, retain, and disclose – any Personal Data that you provide to us or authorize us to collect, including Data that we may collect directly from Customers using cookies or other similar means. As may be required by Law and in connection with this Affiliate T&C, you are solely responsible for disclosing to Customers that Vagabond processes Transactions (including payment Transactions) for you and may receive Personal Data from you. Additionally, where required by Law or Payment Method Rules, we may delete or disconnect a Customer’s Personal Data from your Vagabond Account when requested to do so by the Customer.

If we become aware of an unauthorized acquisition, disclosure or loss of Customer Personal Data on our systems, we will notify you consistent with our obligations under applicable Law. We will also notify you and provide you sufficient information regarding the unauthorized acquisition, disclosure or loss to help you mitigate any negative impact on the Customer.

c. PCI Compliance: If you use Payment Processing Service to accept payment card Transactions, you must comply with the Payment Card Industry Data Security Standards (“PCI-DSS”) and, if applicable to your business, the Payment Application Data Security Standards (PA-DSS) (collectively, the “PCI Standards”). Vagabond provides tools to simplify your compliance with the PCI Standards, but you must ensure that your business is compliant. The specific steps you will need to take to comply with the PCI Standards will depend on your implementation of the Payment Processing Service.

3. Security and Fraud Controls

a. Vagabond’s Security: Vagabond is responsible for protecting the security of Data in our possession. We will maintain commercially reasonable administrative, technical, and physical procedures to protect User Data and Personal Data stored in our servers from unauthorized access, accidental loss, modification, or breach, and we will comply with applicable Laws and Payment Method Rules when we handle User and Personal Data. However, no security system is impenetrable and we cannot guarantee that unauthorized parties will never be able to defeat our security measures or misuse any Data in our possession. You provide User Data and Personal Data to Vagabond with the understanding that any security measures we provide may not be appropriate or adequate for your business, and you agree to implement Security Controls (as defined below) and any additional controls that meet your specific requirements. In our sole discretion, we may take any action, including suspension of your Vagabond Account, to maintain the integrity and security of the Application or Data, or to prevent harm to you, us, Customers, or others. You waive any right to make a claim against us for losses you incur that may result from such actions we may take to prevent such harm.

b. Your Security: You are solely responsible for the security of any Data on your website, your servers, in your possession, or that you are otherwise authorized to access or handle. You will comply with applicable Laws and Payment Method Rules when handling or maintaining User Data and Personal Data, and will provide evidence of your compliance to us upon our request. If you do not provide evidence of such compliance to our satisfaction, we may suspend your Vagabond Account or terminate this Affiliate T&C.

c. Security Controls: You are responsible for assessing the security requirements of your business, and selecting and implementing security procedures and controls (“Security Controls”) appropriate to mitigate your exposure to security incidents. We may provide Security Controls as part of the Application, or suggest that you implement specific Security Controls. However, your responsibility for securing your business is not diminished by any Security Controls that we provide or suggest, and if you believe that the Security Controls we provide are insufficient, then you must separately implement additional controls that meet your requirements. You may review some of the details of our Security Controls on our website.

d. Fraud Risk: While we may provide or suggest Security Controls, we cannot guarantee that you or Customers will never become victims of fraud. Any Security Controls we provide or suggest may include processes or applications developed by Vagabond, its affiliates, or other companies. You agree to review all the Security Controls we suggest and choose those that are appropriate for your business to protect against unauthorized Transactions and, if appropriate for your business, independently implement other security procedures and controls not provided by us. If you disable or fail to properly use Security Controls, you will increase the likelihood of unauthorized Transactions, Disputes, fraud, losses, and other similar occurrences. Keep in mind that you are solely responsible for losses you incur from the use of lost or stolen payment credentials or accounts by fraudsters who engage in fraudulent Transactions with you, and your failure to implement Security Controls will only increase the risk of fraud. We may assist you with recovering lost funds, but you are solely responsible for losses due to lost or stolen credentials or accounts, compromise of your username or password, changes to your Payout Account, and any other unauthorized use or modification of your Vagabond Account. Vagabond is not liable or responsible to you and you waive any right to bring a claim against us for any losses that result from the use of lost or stolen credentials or unauthorized use or modification of your Vagabond Account, unless such losses result from Vagabond’s willful or intentional actions. Further, you will fully reimburse us for any losses we incur that result from the use of lost or stolen credentials or accounts.

We may also provide you with Data regarding the possibility or likelihood that a Transaction may be fraudulent. We may incorporate any subsequent action or inaction by you into our fraud model, for the purpose of identifying future potential fraud. You understand that we provide this Data to you for your consideration, but that you are ultimately responsible for any actions you choose to take or not take in relation to such Data.

Section E: Additional Legal Terms

1. Right to Amend

We have the right to change or add to the terms of this Agreement at any time, and to change, delete, discontinue, or impose conditions on use of the Application by posting such changes on our website or any other website we maintain or own. We may provide you with Notice of any changes through the Application, via email, or through other means. Your use of the Application, API, or Data after we publish any such changes on our website, constitutes your acceptance of the terms of the modified Agreement. You can access a copy of the current terms of this Agreement on our website at any time. You can find out when this Agreement was last changed by checking the “Last Updated” date at the top of the Agreement.

2. Assignment

You may not assign this Agreement, any rights or licenses granted in this Agreement, or operation of your Vagabond Account to others without our prior written consent. If you wish to make such an assignment, please contact us. If we consent to the assignment, the assignee must agree to assume all of your rights and obligations owed by you related to the assignment, and must agree to comply with the terms of this Agreement. Vagabond may assign this Agreement without your consent or any other restriction. If we make an assignment, we will provide reasonable Notice to you.

3. Right to Audit

If we believe that a security breach, leak, loss, or compromise of Data has occurred on your systems, website, or app affecting your compliance with this Agreement, we may require you to permit a third-party auditor approved by us to conduct a security audit of your systems and facilities, and you must fully cooperate with any requests for information or assistance that the auditor makes to you as part of the security audit. The auditor will issue a report to us which we may share with our Payment Method Providers and Payment Methods Acquirers.

4. No Agency; Third-Party Application

Except as expressly stated in this Agreement, nothing in this Agreement serves to establish a partnership, joint venture, or other agency relationship between you and us, or with any Payment Method Provider. Each party to this Agreement, and each Payment Method Provider, is an independent contractor. Unless a Payment Method Provider expressly agrees, neither you nor we have the ability to bind a Payment Method Provider to any contract or obligation, and neither party will represent that you or we have such an ability.

We may reference or provide access to third-party services, products, and promotions that utilize, integrate, or provide ancillary services to the Application (“Third-Party Application”). These Third-Party Application are provided for your convenience only and do not constitute our approval, endorsement, or recommendation of any such Third-Party Application for you. You access and use any Third-Party Service based on your own evaluation and at your own risk. You understand that your use of any Third-Party Service is not governed by this Agreement. If you decide to use a Third-Party Service, you will be responsible for reviewing, understanding and accepting the terms and conditions associated with its use. We expressly disclaim all responsibility and liability for your use of any Third-Party Service. Please also remember that when you use a Third-Party Service, our Privacy Policy is no longer in effect. Your use of a Third-Party Service, including those that have a link on our website, is subject to that Third-Party Service’s own terms of use and privacy policies.

5. Force Majeure

Neither party will be liable for any delays in processing or other nonperformance caused by telecommunications, utility, failures, or equipment failures; labor strife, riots, war, or terrorist attacks; nonperformance of our vendors or suppliers, fires or acts of nature; or any other event over which the respective party has no reasonable control. However, nothing in this section will affect or excuse your liabilities or your obligation to pay Fees, Fines, Disputes, Refunds, Reversals, or Returns under this Agreement.

6. Your Liability For Third-Party Claims Against Us

Without limiting, and in addition to, any other obligation that you may owe under this Agreement, you are at all times responsible for the acts and omissions of your employees, contractors and agents, to the extent such persons are acting within the scope of their relationship with you.

You agree to defend Vagabond, our affiliates, and their respective employees, agents, and service providers (each a “Vagabond Entity”) against any claim, suit, demand, loss, liability, damage, action, or proceeding (each, a “Claim”) brought by a third party against a Vagabond Entity, and you agree to fully reimburse the Vagabond Entities for any Claims that results from: (i) your breach of any provision of this Agreement; (ii) any Fees, Fines, Disputes, Refunds, Reversals, Returns, or any other liability we incur that results from your use of the Payment Processing Service; (iii) negligent or willful misconduct of your employees, contractors, or agents; or (iv) contractual or other relationships between you and Customers.

7. Representations and Warranties

By accepting the terms of this Agreement, you represent and warrant that: (a) you are eligible to register and use the Application and have the authority to execute and perform the obligations required by this Agreement; (b) any information you provide us about your business, products, or services is accurate and complete; (c) any Charges represent a Transaction for permitted products, services, or donations, and any related information accurately describes the Transaction; (d) you will fulfill all of your obligations to Customers and will resolve all Disputes with them; (e) you will comply with all Laws applicable to your business and use of the Application; (f) your employees, contractors and agents will at all times act consistently with the terms of this Agreement; (g) you will not use Payment Processing Service for personal, family or household purposes, for peer-to-peer money transmission, or (except in the normal course of business) intercompany Transactions; and (h) you will not use the Application, directly or indirectly, for any fraudulent or illegal undertaking, or in any manner that interferes with the normal operation of the Application.

8. No Warranties

WE PROVIDE THE APPLICATION AND VAGABOND IP “AS IS” AND “AS AVAILABLE”, WITHOUT ANY EXPRESS, IMPLIED, OR STATUTORY WARRANTIES OF TITLE, MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, NONINFRINGEMENT, OR ANY OTHER TYPE OF WARRANTY OR GUARANTEE. NO DATA, DOCUMENTATION OR ANY OTHER INFORMATION PROVIDED BY VAGABOND OR OBTAINED BY YOU FROM OR THROUGH THE APPLICATION – WHETHER FROM VAGABOND OR ANOTHER VAGABOND ENTITY, AND WHETHER ORAL OR WRITTEN – CREATES OR IMPLIES ANY WARRANTY FROM A VAGABOND ENTITY TO YOU.

YOU AFFIRM THAT NO VAGABOND ENTITY CONTROLS THE PRODUCTS OR APPLICATION THAT YOU OFFER OR SELL OR THAT YOUR CUSTOMERS PURCHASE USING THE PAYMENT PROCESSING APPLICATION. YOU UNDERSTAND THAT WE CANNOT GUARANTEE AND WE DISCLAIM ANY KNOWLEDGE THAT YOUR CUSTOMERS POSSESS THE AUTHORITY TO MAKE, OR WILL COMPLETE, ANY TRANSACTION.

THE VAGABOND ENTITIES DISCLAIM ANY KNOWLEDGE OF, AND DO NOT GUARANTEE: (a) THE ACCURACY, RELIABILITY, OR CORRECTNESS OF ANY DATA PROVIDED THROUGH THE APPLICATION; (b) THAT THE APPLICATION WILL MEET YOUR SPECIFIC BUSINESS NEEDS OR REQUIREMENTS; (c) THAT THE APPLICATION WILL BE AVAILABLE AT ANY PARTICULAR TIME OR LOCATION, OR WILL FUNCTION IN AN UNINTERRUPTED MANNER OR BE SECURE; (d) THAT VAGABOND WILL CORRECT ANY DEFECTS OR ERRORS IN THE SERVICE, API, DOCUMENTATION, OR DATA; OR (e) THAT THE APPLICATION ARE FREE OF VIRUSES OR OTHER HARMFUL CODE. USE OF DATA YOU ACCESS OR DOWNLOAD THROUGH THE APPLICATION IS DONE AT YOUR OWN RISK – YOU ARE SOLELY RESPONSIBLE FOR ANY DAMAGE TO YOUR PROPERTY, LOSS OF DATA, OR ANY OTHER LOSS THAT RESULTS FROM SUCH ACCESS OR DOWNLOAD. YOU UNDERSTAND THAT THE VAGABOND ENTITIES MAKE NO GUARANTEES TO YOU REGARDING TRANSACTION PROCESSING TIMES OR PAYOUT SCHEDULES.

NOTHING IN THIS AGREEMENT OPERATES TO EXCLUDE, RESTRICT OR MODIFY THE APPLICATION OF ANY IMPLIED CONDITION, WARRANTY OR GUARANTEE, OR THE EXERCISE OF ANY RIGHT OR REMEDY, OR THE IMPOSITION OF ANY LIABILITY UNDER LAW WHERE TO DO SO WOULD: (A) CONTRAVENE THAT LAW; OR (B) CAUSE ANY TERM OF THIS AGREEMENT TO BE VOID.

9. Limitation of Liability